Warning signs: What happens when there's excess liquidity in the system? Be fearful when others are greedy.

'And those who were seen dancing were thought to be insane by those who could not hear the music.'

Hi there, thanks for your continued support of this newsletter. I’ve been MIA as I was down with COVID and so were thirteen of my family members - long story, but last month has been crazy hectic and stressful to say the very least. But then, I knew the only way for me to feel sane and like myself again was to get myself to write so here I am. I hope you and your families are doing OK, dear readers. If there’s any COVID-related help you need, please reach out without hesitating.

So now with that out of the way and some renewed optimism, let’s talk about what’s going on in the startup ecosystem! Exciting month so far - it’s literally raining unicorns. As an angel investor, I can’t help but feel joy as my portfolio companies raise their follow-on rounds - but as a 3rd generation entrepreneur, I’m questioning everything. It’s a weird dichotomy that something that is giving me crazy returns albeit “on paper”, also makes me quite nervous to think about where do we go from here?

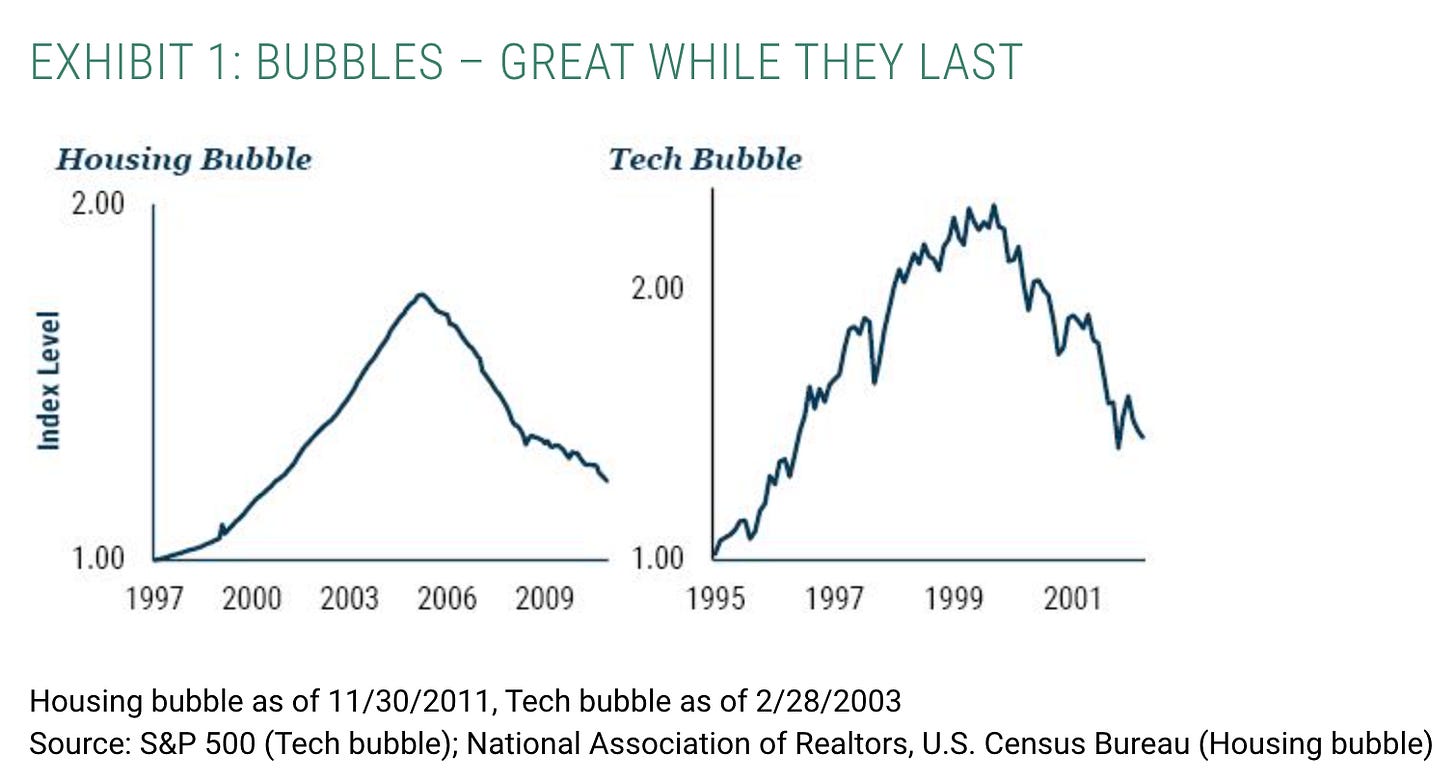

I’ve been in the tech space for 10+ years now, so have seen these crazy liquidity cycles before - but my skepticism stems from knowing what usually comes next, once the “macro liquidity” gets absorbed in the system. Usually, after excess liquidity, a bearish phase follows, startups that raised crazy amounts end up going through down-rounds because they’re unable to raise/have to shut down/or get acquired at low valuations leaving the founders absolutely NOTHING to show for their years of hard work. All the noise and cheer that comes with funding announcements, ends up meaning jack shit when you realize that the business isn’t built on sound fundamentals & that you can’t grow at the pace investors want you to. Don’t get me wrong, I’m long on the India growth story and that is the reason why I invest - but it is worrisome when follow-on rounds happen within weeks of the last fundraise and startups end up getting valued at 3-10X within a few months of operations when NOTHING in the business has fundamentally changed.

Elad Gill, someone who’s writing I admire deeply, recently wrote a post about “End of Cycle?” “One sign that technology markets often exhibit at the tail end of a cycle is a fast diversification of the types of startups getting funded. For example, following the core internet boom of the late 90s (Google, Yahoo!, eBay, PayPal), in early 2000 and 2001 there was a sudden diversification and investment into P2P and mobile (before mobile was ready) and then in 2002-2003 people started looking at CleanTech, Nanotech etc - industries that obviously all eventually failed from an entrepreneurial and investment return perspective.”

Another piece of quality writing on the subject is Waiting for the last dance by Jeremy Grantham. For those interested in learning more, please read the article but my 4 key takeaways from the article to reflect on: 1) Tesla market cap (~$700Billion) VS how many cars it sells and their price point, 2) Market Cap to GDP ratio (The Buffett Indicator) being at an all-time high, 3) the frenzied state of IPOs & SPACs and 4) High P/E multiples as the economy struggles.

“The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.”

I’m bullish on emerging technologies but the breadth of businesses getting funded (SPACs, startups, low-quality public market stocks) by new investors combined with the crypto rush is alarming. DOGE coin first gained recognition as Elon Musk sarcastically joked about it - but then you see it growing 300% week-on-week. As a part of different angel networks, I’ve seen deals getting oversubscribed by Tier2/Tier3 investors who have no idea what they’re putting their money into - they just know they want to invest in “startups”. Given my VC background, I know that most of these deals will never get funded by VCs - and will eventually lead to investors losing 100% of their investment. Not only that, a large number of startups that are raising north of $100MMs, will never be able to match up to investors expectations..because once you raise that kind of money - you’re too big for acquisitions, & the only way for investors to exit the business is through an IPO (which could be an eventual outcome for a few, but certainly not for all). The tragedy even then is that most founders & VC investors actually cash out when they take a company public, leaving the average retail investors at the helm of a collapsing house of cards. I read somewhere recently, “The only thing to fear in the financial markets is the lack of fear itself.”

Btw, have you browsed through Twitter lately? One of the biggest telling signs to me is the emotional rampage investors are on. People can’t stop talking about their 50-1000% portfolio returns - everyone’s a BIG BULL - betting on the mirage that the asset prices will keep rising. But the thing to remember is that it is not how much money you make during a bull market, but how much money you keep once the tide turns. Most digital currency investors think they’re hedging their portfolios by owning crypto - but the fact is that crypto crashes have closely mirrored each stock market crash. It’s a myth that you’re diversifying your portfolio by owning crypto.

“The bubble that formed over the next five years was fed by cheap money, easy capital, market overconfidence, and pure speculation. Venture capitalists anxious to find the next big score freely invested in any company with a “.com” after its name. Valuations were based on earnings and profits that would not occur for several years if the business model actually worked, and investors were all too willing to overlook traditional fundamentals.”

What’s scary is that this excerpt is from an article about the DotCom bubble, but the truth is that it is applicable to what is going on today in the ecosystem. The fact is that this time around, there are millions of people who have got direct exposure because of trading apps and exchanges - the extent of the damage incoming will easily surpass that of the Great Depression, the Dotcom Bubble, & the 2008 crash. The financial losses, coupled with the losses through the pandemic..will leave deep scars on economies and individuals if we’re not careful.

Stay away from speculation, build up cash reserves & be greedy when others are fearful.

If you’re interested in learning more about how excess liquidity is followed by a US recession which results in a boom for India in a 100-year-overview, read here.

If you enjoyed reading this piece, do subscribe. I write a weekly newsletter about investing in startups, crypto and stock markets called ‘The Eudaimonic Investor’.