Learnings from building a Family Office

How are Family Offices different than Venture Capital Funds

I started building SSV (Swadharma Source Ventures), my family office back in 2016. There was very little awareness about what family offices do and I believe it’s still not fully understood. Increasingly, more and more Family Offices are increasing their allocation to the VC/PE ecosystem so I thought I’d write this piece for investors and entrepreneurs either raising from or looking to partner with FOs and make this financial sphere more accessible and comprehensible to outsiders.

Building a family office is akin to establishing a new venture, with a primary focus on capital preservation rather than aggressive capital creation. The concept of family offices can be traced back to the 19th century when J.D. Rockefeller pioneered the idea in 1882. These entities serve as centralized management hubs for substantial family fortunes, overseeing investments, taxes, philanthropic activities, trusts, and legal matters. Drawing from my experiences in both venture capital (VC) and managing a family office, I aim to share valuable insights and shed light on the similarities and differences between these two financial spheres. When I began building my family office, resources were limited, leading me to seek guidance from various Chief Investment Officers (CIOs) and family office promoters. By sharing these learnings, I hope to assist others embarking on a similar journey in navigating the complexities of family office management and help outsiders understand what really goes on within family office structures.

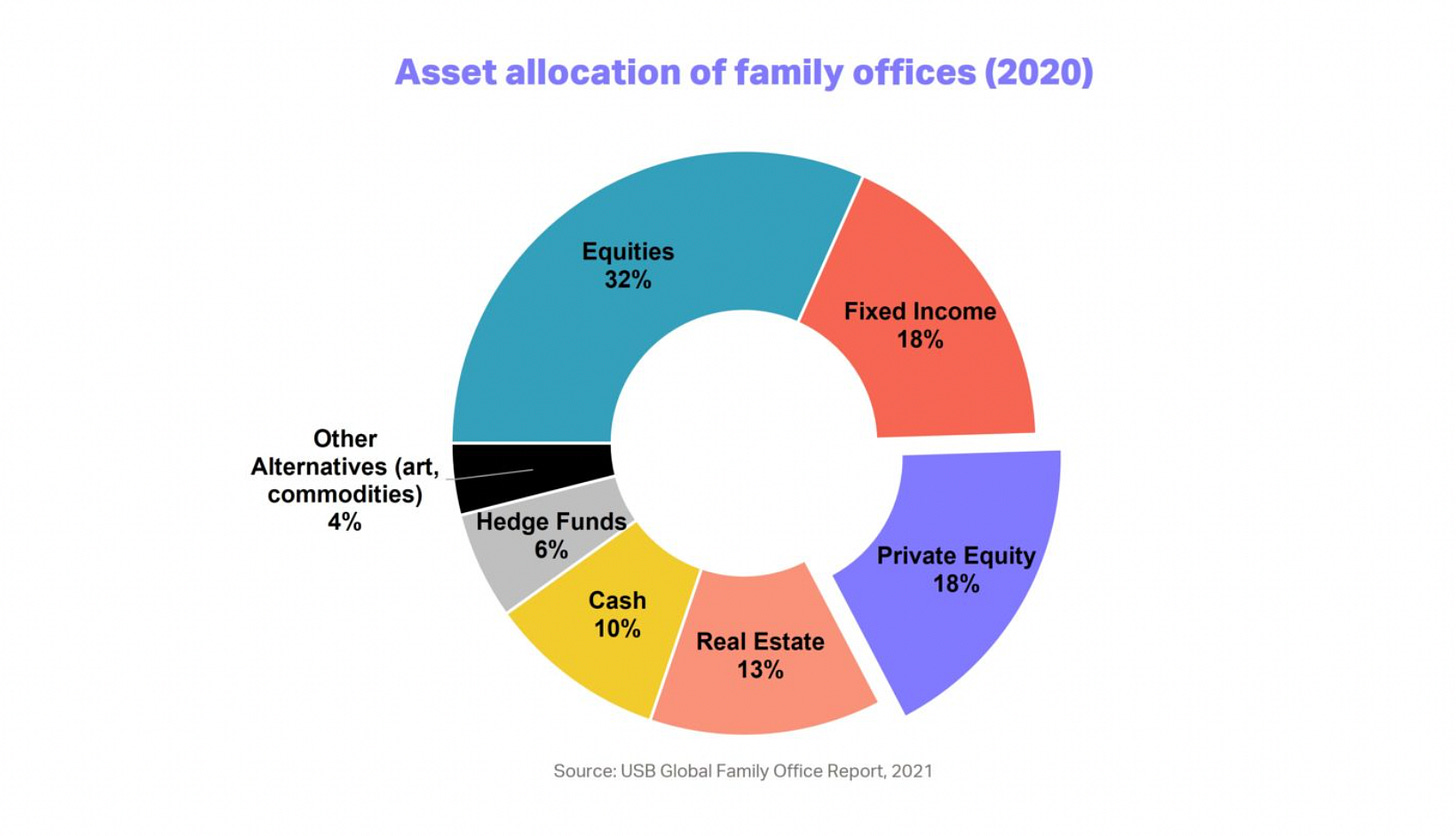

Diversification and Asset Allocation: Family offices usually maintain diversified portfolios comprising equities, bonds, gold, real estate, PE/VC investments, and other asset classes. While they might invest in VC and startups, high-risk asset classes generally constitute only 5-10% of their total investable quantum. Equities and hedge funds often form the largest holdings, followed by fixed income/debt and other investments. Building a brand is essential for family offices seeking access to quality deal flow when investing directly, which sometimes could be by leveraging the main promoter’s name and personal brand. Alternatively, many prefer allocating funds to investment funds and becoming limited partners (LPs), engaging in passive investment. A study conducted by UBS and Campden Wealth in 2021 revealed that family offices allocated approximately 31% of their assets to equities, 15% to fixed income, 15% to direct investments, 14% to real estate, and 6% to private equity. Venture capital investments accounted for about 4% of the total assets on average, reflecting the conservative approach of family offices towards high-risk asset classes.

Liquidity and Investment Decisions: Liquidity plays a pivotal role in family office investment decisions, and it is often impacted during peak and off business cycles for the family's main business. Balancing liquidity needs with long-term investment objectives requires careful strategic planning. Family offices offer a form of patient and long-term capital, as compared to venture capitalists (VCs) who operate on a shorter 10-year horizon. Families, having experienced business growth and compounding, tend to adopt a more patient approach to allow their investments to flourish.

Diverse Investment Goals and Mandates: While VCs primarily focus on backing venture-scale businesses for profit, family offices often have broader objectives that include investing for environmental, social, and governance (ESG) and impact reasons. Family offices tend to support a wider range of business models, not solely focused on venture-scale opportunities. Having said that, each FOs mandate is different, and some may only look at FOs from a capital growth perspective and not an impact vehicle.

Organizational Structures: The size of a family and its wealth may influence the organizational structure of the family office. Larger families typically establish single-family offices, maintaining an in-house team to manage their affairs. On the other hand, families with comparatively smaller fortunes may opt for a multi-family office structure, sharing resources (and knowledge) with other families to enhance economic efficiency.

Alignment and Investment Partnership: Family offices approach investment partnerships differently than traditional VCs. VCs answer to limited partners (LPs) and adhere to Limited Partnership Agreements (LPAs) to invest according to the mandate. Conversely, family offices often invest their own capital and may only need their promoters’ go-ahead to make the final investing decisions. In both cases, usually, there is an Investment Committee (of 3-6 people) to weigh the pros and cons of an investment opportunity. FOs seek alignment with VCs and their investment partners before making long-term commitments and thus may spend considerable time with GPs to ensure compatibility of objectives and values.

Rise of Scions and Family Office Investments: An increasing number of scions, or descendants of wealthy families, are taking the reins of family offices themselves. The 2021 UBS and Campden Wealth Global Family Office Report revealed that 54% of family offices were being led by a scion or a member of the next generation. This generational shift has led to the rise of family offices as prominent players in the investment landscape.

Risk Management: VCs are characterized by high-risk investment strategies, whereas family offices typically adopt a more conservative approach with limited exposure to risky asset classes. Risk management is paramount for family offices, given their focus on capital preservation.

Building and managing a family office presents a unique set of challenges and opportunities, distinct from traditional venture capital endeavors. These learnings and insights can serve as a valuable guide for individuals embarking on a family office journey, providing them with a deeper understanding of the nuances and considerations involved in capital preservation and growth and also to GPs and Founders looking to partner with FOs for their venture funds and startups.